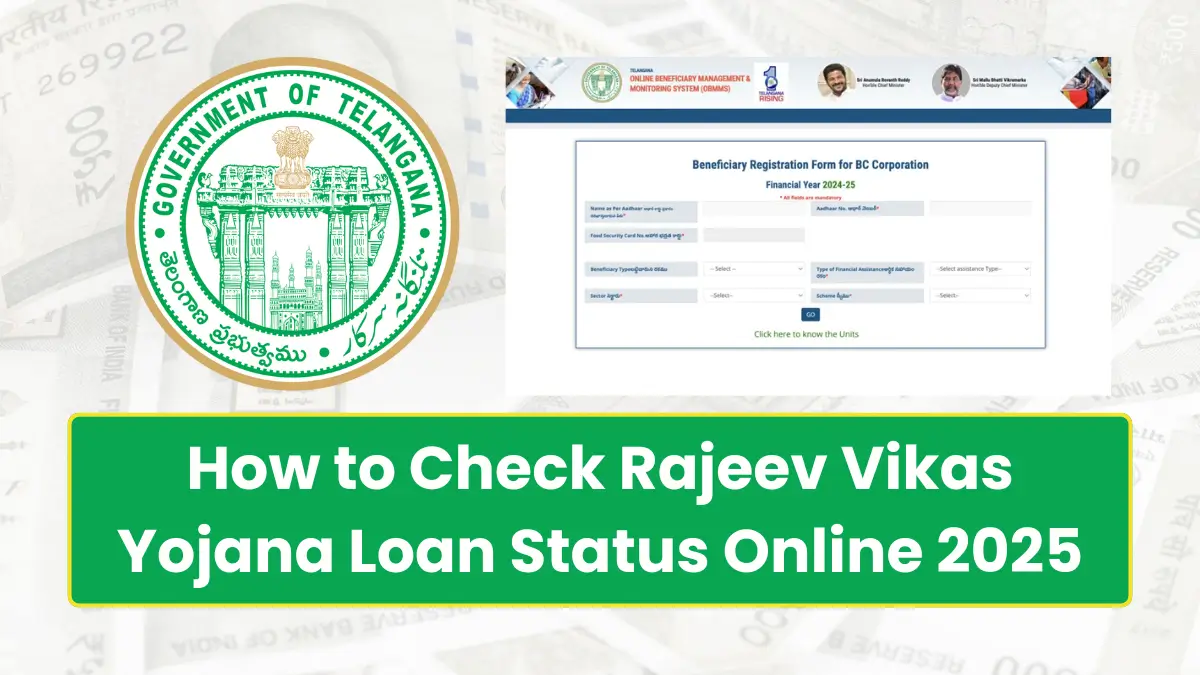

Friends, if you have applied for financial assistance under Rajiv Vikas Yojana and are waiting to know the status of your application, then this article is for you. Many applicants are unsure about how to check their loan status, what documents are required and how their CIBIL score can affect loan approval. Here we will walk you through every step from understanding the scheme to tracking your loan status and improving your credit profile. So let’s know.

What is Rajeev Vikas Yojana?

Let us tell you that Rajiv Vikas Yojana is a government-backed scheme, which has been launched to provide financial assistance to the economically weaker sections of the society. Let us also tell you that its primary objective is to promote financial inclusion and support self-employment and small business initiatives for individuals who struggle to get loans through traditional banking systems. This scheme is very helpful especially for people from backward or rural areas.

Let us also tell you that since its launch, this scheme has helped thousands of beneficiaries to start small businesses, complete vocational training or support livelihood initiatives by offering subsidized loans with simplified procedures.

Key Motive of Rajeev Vikas Yojana

- Number of Beneficiaries: The scheme aims to benefit around 4.9 lakh youth in a phased manner, with completion scheduled by October 2025.

- First Phase: In the first phase, 57,634 beneficiaries have been identified, who were provided with acceptance letters on June 2. The target is to cover a total of 85,000 beneficiaries in the month of June.

- Financial Assistance: Under the scheme, financial assistance ranging from ₹50,000 to ₹4 lakh will be provided to the beneficiaries, depending on the need of the beneficiary and the stage of the scheme.

- Subsidy Allocation: The government has allocated a subsidy of ₹6,250 crore for the approved applications, which will be distributed in a phased manner between June and October.

- District-wise distribution: Sangareddy, Rajanna Siricilla and Khammam districts have the highest number of beneficiaries, while none of the 6,189 applications received from Jayashankar Bhupalapally district were approved.

- ‘One family, one beneficiary’ rule: Under the scheme, only one member from the same family will be selected as a beneficiary, so that maximum number of families can avail the benefit.

- Special focus: An amount of ₹1,000 crore has been specially allocated under the scheme for tribal youth.

Eligibility Criteria for Rajeev Vikas Yojana

If you also want to apply for this scheme, then before applying or checking the status of your loan application, make sure whether you meet the eligibility conditions or not. Here is the information about its eligibility.

- Age Requirement: Applicants must meet the minimum age set by the respective state or implementing authority (usually 18 years or above).

- Income Level: The applicant’s annual income should fall below a specific threshold as defined by the scheme.

- Residency: Applicants must be residents of the region where the scheme is implemented.

- CIBIL Score: Although not always mandatory, a good CIBIL score (750 or above) can significantly increase the chances of loan approval, especially for higher amounts.

Also read:- PM Awas Yojana Gramin Online Apply 2025

Documents Required for Loan Application

To avoid rejection or delays in your application, ensure you have the following documents ready.

- Aadhaar Card

- PAN Card

- Passport-size photographs

- Proof of residence (utility bill or ration card)

- Income certificate from a competent authority

- Caste certificate (if applicable)

- Bank account passbook

- CIBIL report (optional but recommended)

Application Process for Rajeev Vikas Yojana

Here’s a simple guide on how to apply for a loan under the Rajeev Vikas Yojana.

- Collect the Form: Visit your local municipal office, Gram Panchayat, or official government website to obtain the loan application form.

- Fill in Details: Enter accurate information regarding your identity, income, caste (if applicable), and purpose of the loan.

- Attach Documents: Submit the required documents along with your filled form.

- Submit to Authorities: Submit your application to the concerned department — this could be a municipality office, SC/ST welfare corporation, or any authorized body.

- Get Acknowledgement: Upon submission, keep the acknowledgment receipt or reference number for future tracking.

How to Check Your Loan Status Online

It is important to keep track of your loan application status once you have applied. Here is how you can check it online.

- Visit the Official Portal: Go to the official website of the Rajeev Vikas Yojana or the implementing corporation (such as SC/ST Corporation or District Welfare Department).

- Select “Beneficiary List” or “Application Status”: Look for an option that says “Beneficiary List” or “Track Application Status” on the homepage.

- Choose Your Region/Corporation: From the dropdown, select your district, municipality, or welfare corporation name.

- Enter Required Details: Provide your Aadhaar number or application ID as requested.

- Check Status: Click on the “Submit” or “Proceed” button. Your application status will be displayed, including approval status, disbursement stage, or if any action is required.

Why is Your CIBIL Score Important?

Although Rajiv Vikas Yojana does not always require a high CIBIL score, many funding agencies or banks processing the loan may look at your credit history. A good CIBIL score (usually 750 or above) indicates strong repayment capacity and increases the chances of loan approval and faster disbursement.

Tips to Improve Your CIBIL Score

If you have a low score or no credit history, here’s how you can boost it.

- Pay EMIs & Bills on Time: Ensure timely payment of existing loans or credit card bills.

- Limit Credit Utilization: Keep your credit usage below 30% of the available limit.

- Check Your Credit Report: Obtain your CIBIL report from official portals and report any discrepancies.

- Avoid Frequent Loan Applications: Too many credit inquiries in a short time can negatively impact your score.

If you’ve never taken a loan or credit card before, your credit history might be unavailable. In such cases, some state-level corporations may still approve your loan based on income and personal background.

Conclusion

So friends, today in this article we have given information about the application process of Rajiv Vikas Yojana, how to check status online. We hope that now you have come to know about it. If you like the information given in this article, then share it with your friends and also join our WhatsApp channel so that you keep getting more information like this.

What is the my loan stastus

CIBIL score decision

CIBIL score